DDP transactions in the Japanese market

- 2025.04.09

- International International tax International Trade Software Trade & Commerce

- Customs, DDP, global trade, International Tax, International tax Trade & Commerce ACP, Tax planning, trade & commerce

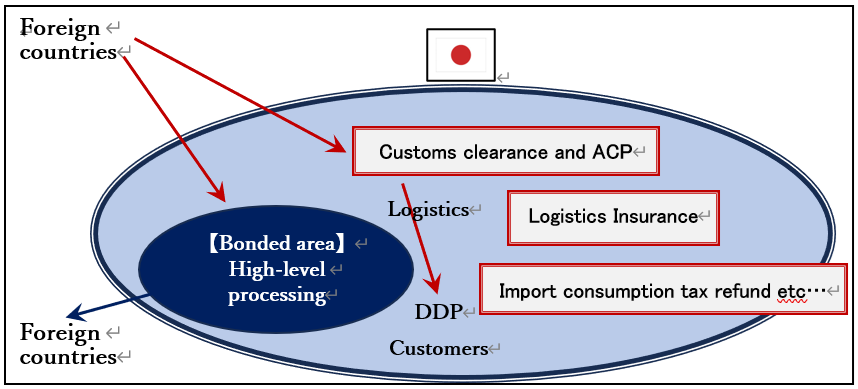

TradeTax Group handles all customs clearance, domestic distribution in Japan, logistics insurance, ACP(=Attorney for Customs Procedures), and import consumption tax refund operations on your behalf

Non-residents of Japan can sell to customers in Japan under Incoterms DDP

The following conditions apply

1. Customs clearance: ACP

From 10, 2023, it will be necessary to appoint an ACP who is a resident of Japan and notify the customs office of this

2. Customs clearance, domestic delivery, logistics insurance

This can be done with TradeTax Group

3. Appointment of tax representative

Non-residents of Japan must obtain a qualified consumption tax payer number

and appoint a tax representative (tax attorney/accountant or tax attorney/accountant corporation)

4. Refund of import consumption tax and consumption tax incurred when delivering within Japan

Selling to individuals using DDP → Refund application

Selling to a corporation using DDP → Issue an invoice and reclaim Input Consumption Tax

5. Eliminate the risk of PE (Permanent Establishment)

If you conduct business activities in Japan, you will be recognized as a PE (Permanent Establishment) and corporate business tax will be imposed

We will provide guidance to eliminate this risk and prepare the necessary documentation for tax purposes

* In addition, you can use Japanese bonded area to carry out high-level processing and ship goods to a third country – > We will act as a bonded area management agent

f you have any questions or concerns, please contact us.⇒

-

前の記事

Security Trade Control do not only apply to “product exports” 2024.07.03

-

次の記事

Global Support as VAT Experts 2025.08.27