Need registration as a ‘Qualified Invoice System’ till March 2023.

- 2022.11.28

- Domestic tax International International tax Trade & Commerce

- import VAT, input VAT, Invoicing System, Qualified Invoicing System

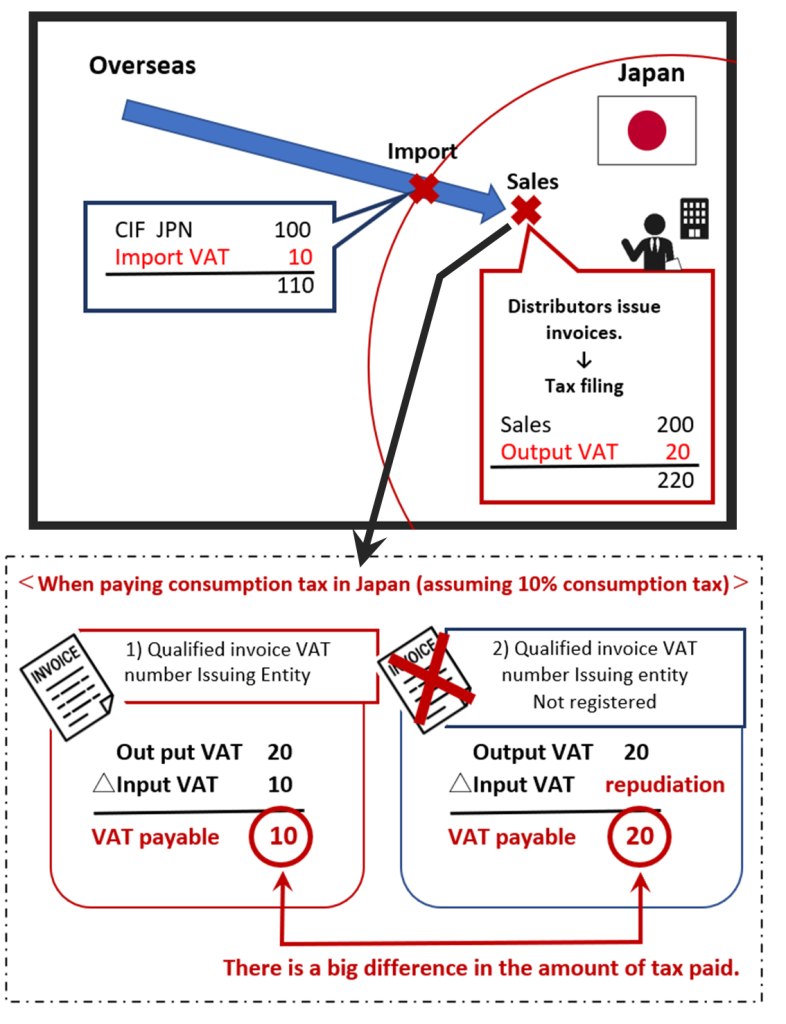

From October 2023, the invoice system for consumption tax will be introduced in Japan.

1.Registration as a ‘Qualified Invoice System’ for existing taxable enterprises (obtaining a VAT number)

In order to deduct Input VAT, you have to register as a ‘Qualified Invoice System’; the deadline is the end of 2023/3. Non-resident Japanese individual enterprises and corporations wishing to deduct Input VAT must register. If a non-taxable enterprise registers, it can deduct Input VAT but must file a consumption tax return.

2.The simplified taxation system

The simplified taxation system applies to individual enterprises and corporations with taxable turnover of up to 50 million yen. Input VAT can be deducted on a deemed basis. For example, in the case of a service business, 50% can be deducted as Input VAT. However, the simplified taxation must be notified in the year before the beginning of the business year. (The simplified taxation must be notified by the end of December 2022 in the case of individual enterprise. If the deadline is missed, this benefit is not granted for the year in question).

3.Transitional measures

Transitional measures have been established to take into account the impact on transactions. For purchases from tax-exempt businesses, an Input VAT deduction of 80% of the amount equivalent to consumption tax is allowed for the first three years after the implementation of the system, and 50% for the following three years.

Contact ⇒

-

前の記事

The regulations are strictly enforced weapons diversion, export and re-export of advanced materials, technologies and programs, etc… 2022.09.07

-

次の記事

Introduction of invoice system 2023.02.13